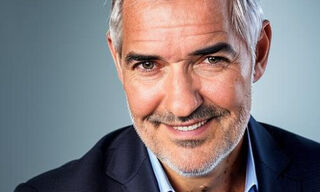

Amaury Jordan joins Supervisory Board at Alpha Leonis Partners, a Swiss-American equity investor.

With offices in Zurich and New York, Alpha Leonis specializes in equity investments. In addition to private and public equity strategies, the company also offers Chief Investment Officer (CIO) outsourcing services.

EasyPark Investment

The boutique manages over a billion Swiss francs in assets from institutional investors and high-net-worth private investors. It is invested in 15 companies, including parking app developer EasyPark.

As the company announces, Amaury Jordan is now joining the supervisory board. He was the co-founder and CEO of Avalor Investment, an independent wealth manager in Switzerland. Additionally, he is a partner at TriLake, another wealth management company based in Singapore, which he co-founded thirteen years ago.

Advocate for Industry Interests

The well-connected financial insider also serves as a member of Lloyd's of London. In Switzerland, he has been involved in advancing industry interests as the founding president of the Swiss CFA Society and later on the board of the CFA Institute, as well as a founding member of the Alliance of Swiss Wealth Managers (ASV-ASWM), where he served on the board until 2021.

David Pinkerton, CEO of Alpha Leonis, who joined the company in 2017, and previously served as CIO at the former Falcon Private Bank for n extended period, commented on the new addition: «Mr. Jordan brings decades of global experience in the investment management industry that will support the future growth of the firm and further build on our continued success.»

«Dramatic Decline of Publicly Quoted Companies»

Jordan references the «the dramatic decline in the number of publicly quoted companies in, say, the US over the last 20 years» as evidence of «the fact that private markets are an increasingly indispensable part of every investor’s portfolio.» He looks forward to working at Alpha Leonis as «one of

the leading independent boutique actors in this space.»