The Swiss cantonal banks last year posted healthy profits despite the economic wobbles and the negative interest rates, thanks to the sale of their fund manager Swisscanto to the biggest institute within their ranks – Zuercher Kantonalbank. The joy won't last.

The Swiss cantonal banks, institutes in their majority owned by the cantons of Switzerland, had a bumper year in 2015: Aargauische Kantonalbank for instance posted a record profit thanks to the money it received from the sale of its stake in Swisscanto fund manager to Zuercher Kantonalbank (ZKB).

The one-time gain is now a thing of the past and a special clause in the contract with the buyer may yet cause some anxiety among the managers of the banks.

Two-Tier Contract

The sellers in December 2014 agreed to a contract with two tiers. ZKB paid a fixed amount of 360.3 million Swiss francs for 81.9 percent of the shares of the joint fund manager. In a second stage, in the years 2016 to 2018, a so-called earn-out clause kicks in. In those years, the sellers will receive amounts that depend on how much the former owner contributes to the success of Swisscanto. How this works in detail remains secret: «The involved parties have agreed that further details will remain secret,» ZKB told finews.ch.

But evidently, the selling cantonal banks will have to work hard to promote the Swisscanto products if they want to see a repeat of last year's bonanza.

New Money Trickle

It won't be easy. New money flowing into Swisscanto funds in 2015 stagnated while ZKB in general was hit by an outflow. The tough start into 2016 may accentuate this trend further.

In addition, a string of institutes launched their own funds in recent months, in competition to the Swisscanto products. The new funds tend to be cheaper, making the sale of Swisscanto funds even more difficult.

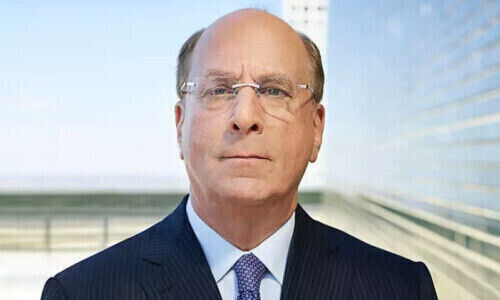

In conclusion, ZKB may yet have bought cheaply: «Zuercher Kantonalbank is covered by the earn-out clause in the contract, should we see further outflows,» ZKB Chief Executive Martin Scholl told finews.ch recently.