Julius Baer had a solid first half in a difficult market. Time will tell whether it will mark the start to a period of growth or rather fizzle out again. Seven questions and seven answers to the Zurich-based private bank's business.

- 1. Reorganization – a Sign of Difficult Times?

Julius Baer last week announced sweeping changes to its business. The reason why the bank chose to reorganize its units was not immediately apparent, including the departures of a string of top managers.

Today it has become clear that the difficult market conditions, with weak demand from clients, a sluggish development in Asia, the jitters on the markets and rising costs, made the bank's extra effort necessary. The reorganization apparently led to disagreements among the management, which in turn prompted some bankers to leave.

- 2. Hiring Drive and Its Risks

The private bank is clearly pushing hard to hire new experienced relationship managers. It has attracted more than 200 so far this year, with the net already exceeding last year's total. The drive is commendable, but comes at a price.

Will the bank be able to reap the benefit from its expansion? Time will tell. When former CEO Alex Widmer last embarked on a similar strategy, it backfired.

- 3. New Strategy for New Money?

Net new money was up 3.7 percent, slightly more than expected but below the bank's target range of 4 to 6 percent. A year earlier, the bank also missed the target, with a result of 3.9 percent.

Julius Baer said net new money inflows had accelerated toward the end of the reporting period. The favorable development however was hit by currency effects, leakage due to ongoing self declarations in France and Italy as well as an unsatisfying situation in Latin America.

- 4. What if Asian Business Remains Sluggish?

«Deleveraging» may sound dynamic, but isn't really. It means that Asian clients are pulling out assets or have lost money due to jitters on the market.

These are bad signs. Asia was an important growth market for Julius Baer in the past decade. If the tide has turned in its second home market, profit will be affected.

- 5. How to Prompt Customers Do Business?

Julius Baer put it bluntly today: Customers have stopped trading, in reaction to the volatility on the markets. This hurts the bank's commission and trading income. Julius Baer isn't alone in this, of course.

Some rivals switched their business to an advisory model, charging clients a flat rate for their services. Julius Baer for instance has done so under the «Your Wealth» brand, but it is to early to say how customers react to this model and what the effect on earnings will be.

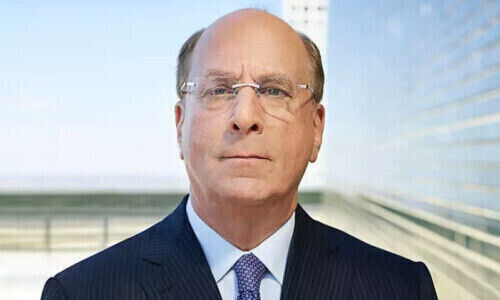

- 6. How Safe Is Collardi?

The stock has risen today, following the publication of the bank's results. Investors clearly have kept their faith in CEO Boris Collardi, even if some have become more critical.

But he hasn't committed any major errors along his strategic business plan. In the increasingly tough environment, he won't be able to rely on impetus from big acquisitions like in past years.

- 7. What Was the Effect of the Takeovers on the Capital Ratio?

The capital ratios have dropped more strongly than expected. The CET1-ratio is 10.2 percent, compared with 12.2 percent in the full year 2015. The reason for this were the takeovers, in particular the acquisition of Kairos Investment Management in Italy.

The purchase of Commerzbank (Luxemburg) was completed on July 4 and will affect the capital ratio in the second half.

These ratios are important indicators of the solidity of a bank. Julius Baer is still going strong, but investors and customers in the current, tough business environment ought not to start doubting the strength of their institute.