How did a venerable 220-year-old German private bank end up owning an online portfolio advisor whose clients invest an average 10,000 euros? Hauck & Aufhaeuser partner Stephan Rupprecht tells finews.com why he thinks this is fintech's breakout moment.

Earlier this year, German private bank Hauck & Aufhaeuser paid an undisclosed sum to buy easyfolio, a two-year-old fintech firm which sells ready-made stock and bond portfolios.

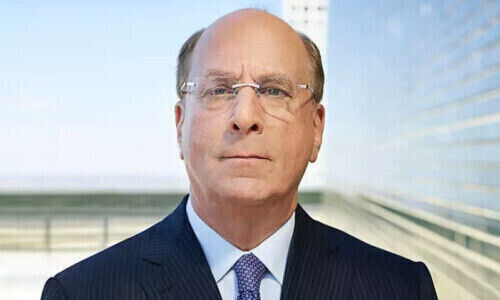

finews.com spoke with Stephan Rupprecht, partner with the Frankfurt-based private bank and former long-time UBS private banker, on the sidelines of a conference hosted by German daily «Handelsblatt».

Mr. Rupprecht, what's does easyfolio give you?

It gives us new insights into rapidity, creativity, and an extremely transparent cost model. We've outsourced almost all our services, and we only do asset management – we do everything else with third parties.

«They're two absolutely separate legal entities, and we're going to leave it that way»

We've created an extremely attractive offering for our clients in terms of costs, speed and quality.

Where does the fintech acquisition fit into your private bank?

They're two absolutely separate legal entities, and we're going to leave it that way. It's possible that a Hauck & Aufhaeuser client might buy an easyfolio product, but equally he could also buy something from a savings bank.

«At the moment, their average client holds about 10,000 euros»

We define private banking as providing an added value for wealthy clients with our advisory service and ultimately with an advisory recommendation. easyfolio is essentially a very simple way to invest money inexpensively, so we don't see any cannibalization or amalgamation.

How do the average client assets of Hauck & Aufhaeuser compare?

We've noticed an uptick in easyfolio's average client assets since Hauck & Aufhaeuser's entrance. At the moment, their average client holds about 10,000 euros.

What about Hauck & Aufhaeuser?

From 500,000 euros. We say that we've made a conscious choice to go slightly «retail» because we believe that we can bring a stock-buying culture to their business and reach a broader audience, which is exactly what we want to do.

So they will enable you to grow more quickly?

We're growing through client referrals, so we have a growth path. But yes, when I look at how many accounts are being opened at easyfolio, it's a dramatically faster rate of growth.

How do you plan to make the acquisition pay off?

We have business cases and plans, but I wouldn't put that in focus at the moment.

«The fintech market will arrange itself in the next 24 to 36 months»

With easyfolio, we have one of the three best-known names in Germany, and that is also our aim in terms of market share – we want to be in the top-three.

How would you recommend that private banks approach fintech?

I'm not in a position to make recommendations. For us, the decisive point was that we believe the fintech market will arrange itself in the next 24 to 36 months. Maybe not down to market share yet, but it's definitely headed in that direction.

That's why we've decided to do this now. We are seeing the fintech market begin to split up and re-distribute itself, and we want to be part of that.

«They are three people, and work in rooms outside the bank»

If we had waited another three years, we would be running behind a train which had already left the station. And then it gets expensive.

How many people work for easyfolio, and do they work at Hauck & Aufhaeuser?

They are three people, and work in rooms outside the bank. They should stay external to so: we want to do everything to preserve their creativity and independence.