While financial services are still mainly associated with private banking in Switzerland, expertise in asset management helps to diversify and complete the industry.

In the previous four sections of this journey through time, finews.com looked at the history of asset management – from the Great Depression of 1929 through to the financial crisis in 2008. With the help of historical documents from T. Rowe Price’s corporate archive, this series discussed many interesting aspects of the industry’s development.

In this last part of this five-piece series, we will look at the progress of asset management in Europe after 2008 and two key questions: how does the industry look today? And why is it important to the Swiss economy?

Having started out in 1937 as a small corporation with only a handful of employees, by 1970, T. Rowe Price had around $6bn assets under management. During this time, U.S. asset management firms began to expand abroad and soon opened offices in Europe. With its long heritage in financial services, Switzerland was an attractive proposition.

Ten Years’ Presence in Switzerland

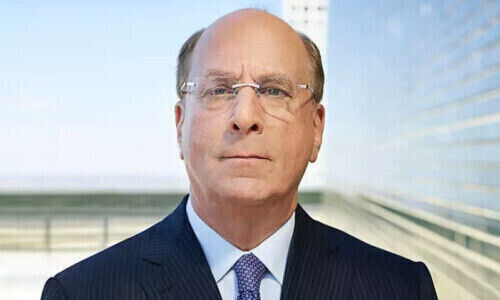

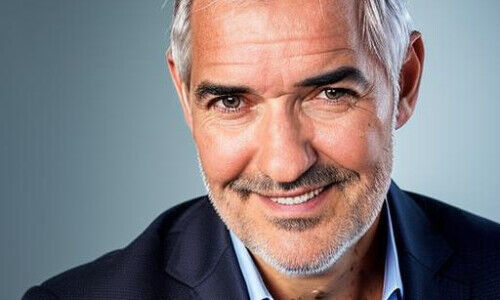

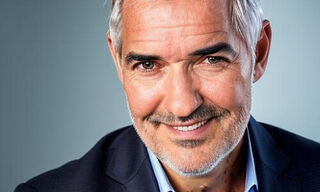

T. Rowe Price opened its Zurich office in 2008 while the industry was being shaken by the global financial crisis. Thanks to its prudent approach to risk management, the Baltimore-based firm survived the turmoil and even continued to hire new employees. In 2012, Paolo Corredig became the head of T. Rowe Price’s business in Switzerland.

(Paolo Corredig has led T. Rowe Price’s business in Switzerland since 2012)

T. Rowe Price recently celebrated its 10th anniversary in the alpine country and Corredig remarks how «compared to other asset managers, we entered this market relatively late». However, he highlights that T. Rowe Price now employs around a dozen people in its Swiss office.

Principles Guide Everything

But why do Swiss clients trust this Baltimore-based asset manager? When asked, Corredig said he believes this comes down to the firm’s core principle: when we take care of our clients, they will take care of us.

«This principle continues to guide everything we do», Corredig states. In his view, this is one of the reasons why the firm continues to grow in Switzerland. «We cover all the country’s geographical regions, with relationship managers fluent in each local language – German, French and Italian. In addition, we continue to receive good support from our headquarters in Baltimore, as well as from our European headquarters in London,» he added.

Growth in Europe and in Switzerland

Within 15 years, T. Rowe Price opened further offices in Europe: Copenhagen in 2001; Amsterdam in 2004; Luxembourg in 2005; Zurich in 2008; Stockholm in 2010; Milan in 2014; and Frankfurt and Madrid in 2015.

(A map of T. Rowe Price’s offices in Europe)

In Switzerland, asset management has become an important branch of finance. Why is that so? «The financial sector is of central importance for the Swiss economy and accounts for approximately ten percent of GDP», state Swiss academics, Jürg Fausch und Thomas Ankenbrand in a 2018 study. While «financial services in Switzerland are still mainly associated with private banking and wealth management, strong expertise in asset management helps to diversify and complete the Swiss financial services industry».

Three Times the Size of GDP

In their study, Fausch and Ankenbrand found that roughly «9,600 people are directly employed by asset managers in Switzerland and [that] roughly 44,500 people are indirectly employed in the industry’s wider scope».

According to Fausch and Ankenbrand, «the total volume of assets managed by banks, fund management companies, securities dealers and Finma-supervised asset managers in Switzerland amounted to 2208 billion francs at the end of 2017». This is roughly three times the size of the national GDP.

Attractive Factors

For asset managers, Fausch and Ankenbrand highlighted several factors that make Switzerland attractive. These include positive economic growth expectations, low government debt, a sound fiscal position, and low inflation expectations.

(Switzerland provides attractive conditions for the asset management industry)

It is no surprise then that many global asset managers have written positive chapters in their histories after opening offices in Switzerland.

What next?

- How will asset management progress? Thus, we would like to invite our readers to take part in our survey about the future of asset management.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction. Switzerland - Issued in Switzerland by T. Rowe Price (Switzerland) GmbH, Talstrasse 65, 6th Floor, 8001 Zurich, Switzerland. For Qualified Investors only. © 2019 T Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE and the Bighorn Sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.

201907-896764