Switzerland's finance regulator sanctioned on Julius Baer after the wealth manager turned up in a Venezuelan graft scandal and another big money laundering crime site.

The Swiss private bank is prohibited from any major acquisitions and will get an outside minder, Swiss financial regulator Finma said in a statement on Thursday. The move caps a nearly three-year investigation after Julius Baer was smeared in two major money laundering scandals, PDVSA and FIFA.

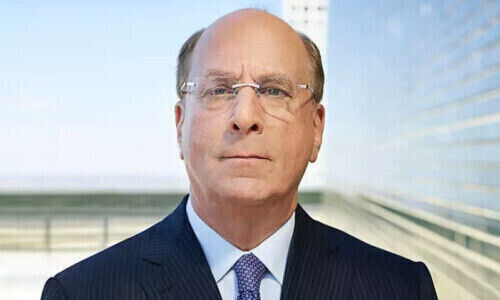

Finma's sanction overlaps almost exactly with the tenure of ex-CEO Boris Collardi, who is now a partner at Geneva's Pictet. From 2009 until two years ago, «Julius Baer had a poor compliance and risk culture in which legal obligations to combat money laundering were not given the required degree of importance,» Finma said.

Costly Clean-Up

Julius Baer acknowledged the sanctions in a statement on Thursday. The bank pointed to new leadership as well as a costly, two-year clean-up which scoured all the bank's accounts.

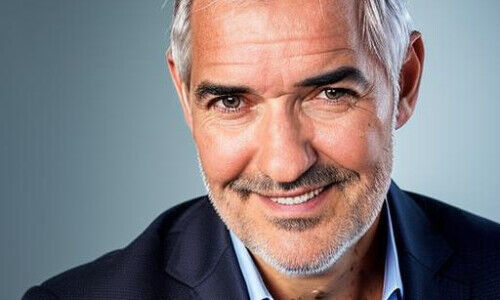

CEO Philipp Rickenbacher has pledged to shift focus away from hiking net new money at all costs towards better profitability. Julius Baer has also installed a new executive, ex-Goldman banker Beatriz Sanchez, to oversee Latin America as well as abandoned Venezuela.

Know-Your-Customer Deficiencies

The clean-up is overdue, if the Finma findings are anything to go by. The Bern-based authority said that almost all of the 70 business relationships selected on a risk basis and the vast majority of the more than 150 sample transactions selected showed irregularities.

Specifically, the bank didn’t do enough to determine the identities of clients, nor did it establish the purpose or background of its business relationships. Information contained in «know your customer» documentation was either incomplete or ambiguous.

Misplaced Incentives

«Information was frequently missing as to how individual clients had come by their wealth, why they wanted to open an account with Julius Baer and what business they were planning to transact,» said Finma. «Transactions were not properly monitored or were insufficiently queried, in a period in which Julius Baer was presumably seeing clear warning signs of money laundering activity.»

Organizational failings and misplaced incentives encouraged breaches of the legal obligations to combat money laundering, said Finma. The bank’s remuneration system focused almost exclusively on financial targets and paid scant regard to compliance and risk management goals.

Measures to Be Implemented

Finma has ordered Julius Baer to take a series of measures. It requires the bank to fully implement those in the near future and that legal requirements to combat money laundering are observed effectively:

- The bank must put in place a process for identifying those client advisers whose client portfolio carries a high money-laundering risk, for assessing the identified risks and for suitably containing them.

- The bank must make changes to its remuneration and disciplinary policy so that incentives are no longer offered to generate the highest possible returns at the cost of unreasonable risk-taking or compliance failures.

- The bank must establish a board committee specializing in conduct and compliance issues, or set up a similarly effective mechanism.

- Until it is once again fully compliant with the law, the bank is prohibited from conducting transactions such as major acquisitions that lead to a significant increase in operating risks (including but not limited to money laundering risk) or in its organizational complexity.

Further Proceedings May Follow

Finma has appointed an independent auditor who will monitor the implementation of these measures.

After its assessment of Julius Baer as a whole, Finma will now examine, whether to begin proceedings against any individuals, it said in the statement.