While the changes at the top of both big Swiss banks happened almost simultaneously, the two are now embarking on journeys into very different directions. This may free huge potential.

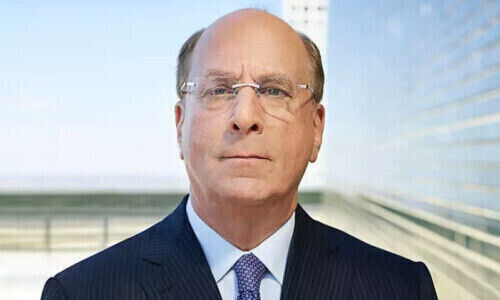

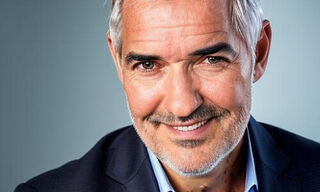

The surprise appointment of Ralph Hamers as new CEO of UBS drew immediate comparisons between his new and his earlier employer, ING Group. But the comparison with the much smaller Dutch bank falls well short.

The Swiss bank is exposed to much stiffer competition from local rival Credit Suisse – where, by chance, there had been a change at the top only a few days earlier: Swiss banker Thomas Gottstein replaced Ivorian-French manager Tidjane Thiam.

The Same Focus

True, Credit Suisse is also smaller than UBS, but its business model is much closer to UBS’ than ING’s. What’s more, the strategies of the two Swiss banks have converged over recent years and probably become as close as never before. Both banks are focusing on the business with the rich – wealth management – while reducing their exposure to the U.S.-style risky investment banking.

Other than that, they also had and still have a strong domestic business. But, both companies were forced to acknowledge that investors aren’t overly impressed by their strategy. The shares are worth a fraction of what they used to be twenty years ago.

Also-Ran Banks

- Page 1 of 2

- Next >>