Swiss private banks and wealth managers are eying some of their best half-year results ever and not just because of soaring markets and more active clients.

Online bank Swissquote was not the only Swiss financial institute to declare itself on course for record high profits, derivatives specialist Leonteq also announced it was heading for a bumper first half.

It’s no coincidence that Swissquote and Leonteq are highly digitized companies which are able to convert greater client activity and trading volumes directly into increased profits.

Banking Stocks Rising

Both asset managers and private banks are benefiting equally from the current market environment. This is in turn being reflected in their share prices.

Julius Baer, one of Morgan Stanley’s favorite financial stocks is trading close to an all-time high. Vontobel shares have climbed to levels last hit before the 2008 financial crisis. Even asset manager Bellevue’s shares are at their highest in 10 years. Swissquote too is flirting with a record high.

Even UBS’ shares have risen 16 percent so far this year despite the hit from the collapse of hedge fund Archegos. On the other hand both Archegos and the Greensill debacles have kept Credit Suisse shares stubbornly below 10 francs ($11).

Volumes growing

Market conditions are almost perfect for private banking, even the interest rate curve is rising again. Above all, it is the bull run on the stock markets which is driving the profits from wealth management and trading.

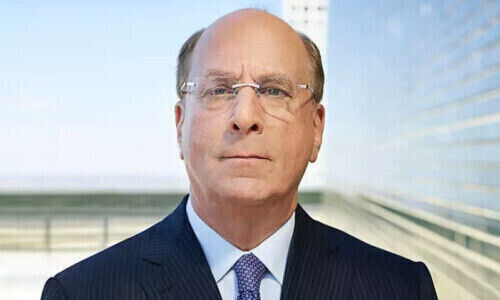

«The volumes too: The level of assets under management rose last year and they are profiting from that now because their clients are highly active,» KPMG Switzerland partner for financial services Christian Hintermann told finews.com.

High Savings, Low Interest Rates

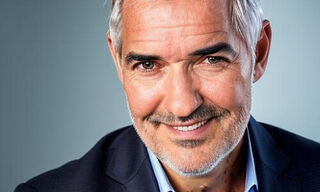

His colleague at Deloitte, Jean-François Lagassé, pointed out that a client group which had so far been paid little attention was now generating revenue.

«During the pandemic, the savings rate among all banking clients has increased. The funds from retail investors are now increasingly flowing into low-cost investment products such as ETFs as they also want to benefit from the uptick in the market,» he told finews.com.

He also drew attention to another factor: «Private and retail banks are passing on more and more negative interest rates to their clients. They are therefore forcing their clients to become more active in the markets with their cash.»

Covid-19 Effect

There are some factors on the cost side which make the cost-income ratios look good. First of all there is the coronavirus’ effect on costs: less business travel, lower expenses as well as less spending on events and sponsoring.

Investment Paused

Lagassé said that when the pandemic broke out last year many banks slowed down or put their investment programs on hold, which also lowered costs.

«They are only now starting to ramp up these programs again», he added.

Risk of Correction

Lagassé said the banks would have to live with the risk of a market correction and that in the short term they would profit from it due to the resulting volatility.

However he warned that «their earning power would be significantly affected as private investors, having suffered market losses, would be hesitant to re-enter the market. That, combined with negative interest rates, would significantly impact their ability to generate revenue».

Papering over Cracks

Hintermann added: «The favorable environment is hiding some of the problems. There is a whole swathe of private banks in Switzerland which are wrestling with too high a cost base.»

Another sign of the markets being in a hype phase was the determination of some banks to make acquisitions.

Consolidation

«Valuations have also risen sharply, we are seeing banks willing to pay very high prices for an acquisition,» Lagassé said. However, the fair wind in the markets had reduced the pressure to consolidate.

Hintermann added: «There’s no shortage of potential buyers, but of course fewer want to sell at the moment.»