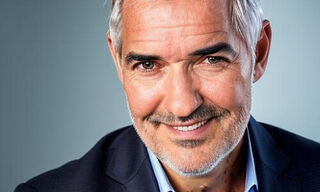

Although Markus Diethelm left an indelible stamp on the «new» post-2008 UBS, he departs with unfinished business.

Monday will be a decisive day for UBS and its top lawyer, Markus Diethelm. A French judge will rule on the tax case. Nobody is wagering on the outcome. French government prosecutors are seeking a fine of at least 2 billion euros and 1 billion euros in damages and interest.

The original penalties imposed on the bank in 2019 consisted of a 3.7-billion-euro fine and 800 million euros in civil damages. But the sum could end up being much less because the way that tax evasion fines are calculated has changed since the first ruling.

On the Way Out

How large the penalty ends up being is likely to be one of the deciding factors as to whether UBS appeals the case to the European Courts. Markus Diethelm, the UBS General Counsel, will have a key hand in that decision.

It has been widely known that the 64-year-old has been on his way out since the announcement in April that he would be replaced by Barbara Levi from this November. But Diethelm has been on this case from the start. He appeared in court in Paris in February 2019 when UBS was fined 4.5 billion euros when he decided not to seek a settlement and instead appeal the judge's ruling.

We do not know if he was being too stubborn or whether it was because of then CEO Sergio Ermotti, who rejected an earlier, cheaper settlement. What we do know is that both he and fellow lawyer Peter Nobel misjudged the case as the judge made what seemed to be a political decision, and one not based on international law.

Playing with his Reputation

Diethelm himself said that he was playing with his reputation and that he lost. When he announced him leaving UBS the appeals process had been set in motion, he seemed to have regained some of his self-confidence.

His objective has always been to conclude the French case and it was also the board's. He will be at UBS until November, which sounds like he believes the outcome will be an acceptable one.

Choppy Waters

He has been at UBS for over 13 years, seven of them as part of the executive board as General Counsel. He started his job in very choppy waters, coming to UBS when it was in dire straits. The Swiss National Bank had to use taxpayer funds to keep the bank afloat during the 2008 financial crisis and the government then had to step in and help in the US tax evasion case just a few years later.

UBS staged a strong recovery after all that. It embarked on a new strategy from 2011 onwards, solidifying its place as the world's largest wealth manager. But the post-crisis era was also a time of cleaning up, as it was for most other major banks. It would be impossible to count the number of fines UBS has paid over the last ten years, from tax evasion, market manipulation, LIBOR, foreign exchange and commodities - to sub-prime. The internal compliance function grew in parallel with all that, resulting in a clearer separation with legal.

According to Diethelm, UBS had been threatened with far higher penalties. And a person close to him says he is not one to shy away from a fight and it was due to his work in many cases where he astutely assessed the evidence, choosing whether to cooperate or not.

Naturally, he also gathered teams of very high caliber around him. But most of the time, as in Paris, he was doing the talking.

Almost Extinct

The fact that he shows up in court in person separates him from most other corporate lawyers and it is likely he learned to love sparring in court when working at a number of prominent US law firms. In this day and age, managers who take any kind of personal responsibility are becoming almost extinct in the corporate world. But Diethelm was always different. When at Swiss Renegotiating the liabilities from 9/11 terrorist attack on the Twin Towers, he fought Silverstein's two-occurrence claim and won when the judges ruled it was a single attack and not two.

Not only Friends

Of course, as everyone at that level, he has his detractors. What is undeniable is that he was a constant mentor to his teams and he actively supported women in their careers. Some say he gave off the appearance of being "non-bank" in a bank even though he knew UBS inside and out. The fact of the matter is that he did stand out in his dressing style from those wearing dark grey suits around him.

The overbearing question is what will he do now? He has clearly said no to a career as a professional non-executive director at the boards of other companies. People say he remains open to another corporate job, even one outside the financial industry. It is also said he would like to personally handle UBS-CEO Ralph Hamers case related to money laundering in the Netherlands even though it remains unclear if there will be any charges.

Whatever happens, there will be a judgment handed down in France. And the ruling is will be decisive for his legacy.