On Wednesday, the highest French court will rule on UBS's appeal of the tax dispute verdict against it. The saga has been running for almost ten years and counting. Still, anything can happen.

It feels like UBS has been carrying the burden like forever as we are just a few months short of the French tax dispute turning ten. To wit, it was back in 2014 when authorities started officially investigating the case, with the first charges being raised in March 2017.

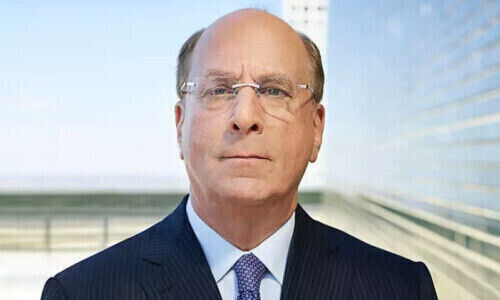

The trial overshadowed the end of Sergio Ermotti's first term as UBS's chief executive officer in the autumn of 2020. Regardless, he is probably still conversant about the matter now that he has returned. The big question is whether the bank's position has changed at all. Until recently, it did not appear to budge much from its stance after the first verdict against it, even calling it a question of honor.

We will find the answer shortly. On November 15, France's highest court will rule on the appeal even though much related to the original verdict remains surprisingly open-ended.

Soliciting Clients

French authorities accuse UBS of illegally soliciting wealthy clients between 2004 and 2012 and helping them to use domestic banking confidentiality laws to hide money from the tax authorities.

In December 2021, UBS was found guilty by an appeals court in Paris following a ruling after the first hearing that threatened the bank with a then-record fine of 4.5 billion euros ($5.1 billion dollars at the time). The bank was found guilty of engaging in illicit financial transactions and money laundering aggravated by tax fraud by soliciting French clients to open undeclared accounts in Switzerland.

Paid Damages

On appeal, the penalty was very significantly cut to 1.8 billion euros, of which 1 billion of the total comprised the fine itself and 800 million euros in damages to the French state. At the time, as we now know, UBS decided not to accept the lower fine.

The appeal, however, only questions the fine as the damages to the French government have already been paid.

The outcome of the decision now is completely open. The case could be repealed, or revised, while the fine could be adjusted up or down. It could also be simply reconfirmed.

Reputational Damages

Until now, the bank has always vehemently disagreed with the ruling, even in Ermotti's first term. It believes it should be acquitted. Being convicted of acting criminally was always deemed as too damaging to its reputation as it could have an unforeseeable impact on its business in other countries. It is questionable as to whether the view of UBS general counsel Barbara Levi has changed at all.

It is, however, possible that UBS will accept the ruling next Wednesday. A moderated fine would help to build a bridge between the two sides given that an entirely new judgment on the case is not the job of the court.

If UBS again wants to appeal the case, the only thing it can do is go to the European Court of Human Rights. But they have taken that path before and things did not turn out well.

New Tactics

In the meantime, it is also possible that Ermotti now has other priorities given the massive job it has ahead of it of integrating Credit Suisse.

The past few months have shown that UBS has been willing to give in and settle a number of legal matters related to Credit Suisse. Moreover, it has booked about $4 billion in additional legal provisions for both legal and regulatory risks at its now subsidiary, once Switzerland's second-largest bank.

French Provisions

UBS itself has booked about 1.1 billion euros in provisions for the French tax case. In its full third quarter 2023 report, it comments on the case, noting a «wide range of possible outcomes in this case contributes to a high degree of estimation uncertainty».

It further added that «the provision reflects our best estimate of possible financial implications, although actual penalties and civil damages could exceed (or may be less than) the provision amount», it warned. If nothing else, it probably serves as an indication of the uncertainty it faces this coming Wednesday.