The world’s oldest cryptocurrency outperformed all other asset classes in 2023. Whether Bitcoin will continue along its upward trajectory will depend in part on the U.S. Securities and Exchange Commission deciding to approve Bitcoin ETFs, according to Nicolas Marxer, Head of Blockchain Banking at the Liechtenstein-based industry pioneer Bank Frick, in an interview with finews.

Mr. Marxer, Bank Frick was an early adopter of trading and custodian services for cryptocurrencies in the regulated banking sector. What were the «aha» moments that your company has since experienced in the cryptocurrency business?

Bank Frick is Europe’s trailblazer in blockchain banking. It was already operating in cryptocurrencies in 2018. Our openness to blockchain and cryptocurrencies has helped us gain global recognition and propelled all the bank’s business areas to strong growth.

We’re proud we recognized the possibilities of this technology early on and took advantage of the opportunities that come with it.

What appealed to you about cryptocurrencies like Bitcoin back then?

At the critical moment, we realized the potential of cryptocurrencies’ underlying technology and the possible applications. At the same time, we understood customers’ need for a bank that recognizes this potential and develops products that will effectively help them in their day to day work.

«Blockchain banking is just as important as the other business areas.»

In this business sector, the same strict conditions apply as they do for all other sectors. Complying with them is essential and very important to us.

How important is this business segment for your bank now?

Our bank is currently active in four business areas, one of which is Blockchain banking. This area is just as important as the other business areas. Customers from the traditional banking or funds business areas can also benefit from our products in the crypto sector and take advantage of them.

How do you convince investors who are not yet invested in cryptocurrencies to invest in this asset class?

We don’t offer any advice on this subject. We don’t therefore want to convince anyone to invest in crypto. But we’re fortunate in that our reputation attracts customers who are already convinced and want to use our services and services for their investments.

What demand has there been from institutional investors in Switzerland and Liechtenstein?

There has been a significant increase in demand, particularly among institutional customers in Switzerland and Liechtenstein. We can see a growing interest in these markets, which is reflected in increased demand and an uptick in customer activities in this area.

«We handle cryptoassets just as carefully as we do with traditional assets.»

What do you think is currently the biggest obstacle to institutional investors including cryptocurrencies in their portfolios?

The partial lack of legal certainty is a big risk, so institutionals must protect their own clients. It is essential for all laws and regulations to be clearly defined. Many people see cryptocurrencies as speculative instruments.

How do you deal with this?

We always have the highest standards when it comes to complying with banking regulations and consider this to be an integral part of our bank. Ensuring the safety of our clients’ assets is our primary focus. We handle cryptoassets just as carefully as we do with traditional assets. Our clients’ assets are not exposed to any counterparty risk and are therefore secure at all times.

Are there differences in the way Liechtenstein and Swiss financial companies deal with the topic of cryptocurrencies?

There are no substantial differences, only similarities. Both are increasingly having to deal with this issue, driven by the rising number of client inquiries.

What crypto service will Bank Frick surprise us with next?

We’re doing everything we can to bring innovative and exciting products to the market in 2024. We can’t reveal any more details at this stage but get ready to be thrilled!

Is the cryptocurrency market already turning bullish?

After trending sideways at around 30,000 dollar for a long period, Bitcoin, along with the entire crypto market, broke out to the upside at the end of the year. We’re now seeing a renewed consolidation around 40,000 dollar. Whether it will continue along its upward trajectory will depend on a number of factors such as the forthcoming decision by the U.S. Securities and Exchange Commission (SEC) on approving Bitcoin ETFs and the Bitcoin halving in spring 2024.

«A signal like this from the USA would greatly benefit the entire market.»

What can we expect in the coming year?

We’re witnessing a growing adjustment in the institutional market segment, mainly driven by improved legal clarity, regulations, and the emergence of new use cases. This is basically a positive development. This development also largely depends on media exposure, which in turn is influenced by how the price does in the crypto sector.

What role does a Bitcoin halving play in the cryptocurrency markets?

In the past, a Bitcoin halving has always boosted the market and price. It’s considered a key event. But the degree to which it affects the market will depend heavily on the situation there at the time of the halving.

Will the SEC finally approve Bitcoin spot ETFs in the U.S.?

A signal like this from the USA would greatly benefit the entire market. We can’t predict whether the SEC will ultimately grant approval.

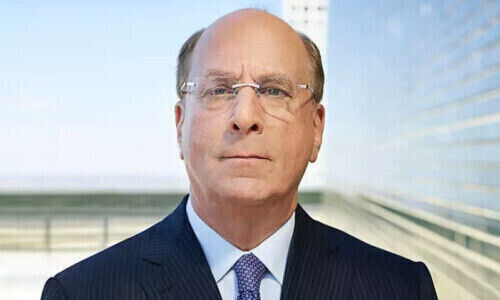

What are you expecting from Blackrock’s entry into the cryptocurrency industry?

If large institutional companies enter, it will support the entire market and send out a clear signal. If Blackrock moves into the crypto business, we predict this will be a positive sign for other institutional market participants

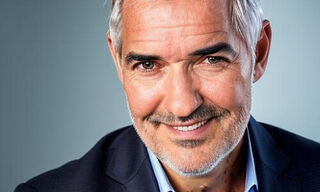

Nicolas Marxer has been working at Bank Frick since 2016 and has made a reputation for himself through his expertise. He has been Head of Blockchain Banking since July 2021, a role that reflects his extensive experience and expertise in this field. The Liechtenstein-based bank celebrated its 25th anniversary at the end of December 2023. It specializes in banking for financial intermediaries and professional clients. The financial institution has been offering trading and custodian services for leading cryptocurrencies in the regulated banking sector since 2018.