The events of the past 12 months have permanently reshaped the Swiss banking landscape. This raises a number of questions that finews.ch has researched and found answers to.

1. Will UBS be able to integrate Credit Suisse?

Colm Kelleher and Sergio Ermotti (from left, image: Keystone)

Yes. UBS has already demonstrated these past few months what it can do. Events will move at the same pace in 2024 – CEO Sergio Ermotti and chairman Colm Kelleher, who are both looking to leave a legacy, are making sure of it with this «exercise.»

Due to the bank’s systemic importance, numerous authorities and entities are keeping it under their watchful eye and would presumably intervene early on if it looked as though something was to go wrong – in contrast to Credit Suisse, where the nonchalance of some authorities only made a bad situation worse.

2. Can Bank Julius Baer ride out the storm with its client René Benko?

Julius Baer’s head office in Zurich (Image: finews.ch)

No. Everything indicates that Julius Baer intends to wait out the turmoil with its client René Benko. That can be the only reason for the radio silence, which is expected to continue until February 1, 2024, when the bank unveils 2023 figures and outlook. But it is doubtful whether that will be enough.

Julius Baer has not done itself any favors by its obfuscations regarding responsibilities within the company following the debacle. The management and the board of directors have come across as weak as a result. What the share price does from now will be decisive.

The hesitant advances in the price that we have seen are still a long way from indicating a turnaround. There are plenty of indications that personnel changes are inevitable.

3. Will Vontobel’s dual management be enough to impress?

Georg Schubiger and Christel Rendu de Lint (from left, image: Vontobel)

No. Another venerable Zurich banking institution is going through a sticky patch too. Vontobel started the new year with a dual management team. Christel Rendu de Lint and Georg Schubiger succeeded Zeno Staub.

The duo and the resulting new management organization have failed to impress, even if Vontobel chairman Andreas Untermann never tires of claiming the opposite in public. The two co-CEOs are so absorbed with the work in their respective divisions (Investments and Wealth Management) that the bank’s overall management may be neglected under these circumstances.

The departure of media «spin doctor» Peter Dietlmaier means the person who would have been best able to manage perception outside the organization is missing – and although this may seem to be a minor detail it is an important one.

4. Is the renaissance in crypto supplanting the sustainability trend?

Copenhagen (Image: finews.ch)

Yes. In recent years, the topic of «sustainability» has become a welcome marketing tool for most financial institutions and allowed them to position themselves as the creators of a better world, while making moolah in the process. Unfortunately, the world has not gotten much better over this period. In fact, it has even become worse in some respects, which in turn has shifted the priorities of bank customers.

In light of the ongoing geopolitical conflict, uncertain interest rate environment, and fears of a recession, they are now prioritizing saving, capital preservation, and the «home advantage.» Most people currently have little understanding of «extra mile sustainability.»

By contrast, the social acceptance of digital currency is likely to consolidate after the apparent ending of the «crypto winter,» not least owing to rising levels of debt in many countries and declining trust in state institutions.

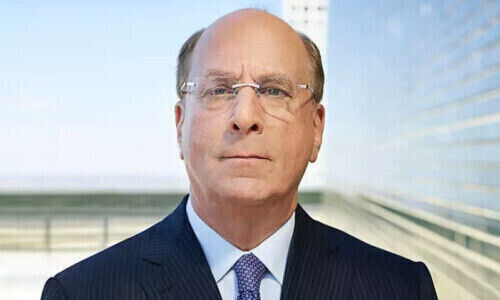

5. Will Thomas Jordan remain chairman of Swiss National Bank for much longer?

Thomas Jordan (Image: Keystone)

No. There are some pointers that Martin Schlegel (image below) will soon succeed Thomas Jordan as chairman of the Swiss National Bank (SNB). In the last few months, he has been the mouthpiece of the SNB on various occasions and so has taken on an important role that would otherwise be the chairman’s responsibility.

Martin Schlegel (Image: SNB)

Jordan has chaired the SNB Governing Board since April 2012 and built an impressive track record. With the provisional end of the interest rate hike cycle and the end of the period of uncertainty enveloping Credit Suisse, the SNB has also opened a new chapter, as best expressed by having a new chairman.

A change would also mean an opportunity for a woman to move back onto the board following the departure of Andréa Maechler.

6. Does it make sense for a slew of Swiss financial institutions to expand into the Middle East?

Dubai (Image: Shutterstock)

Yes. For approximately two years, scores of banks and asset managers have been flocking to the United Arab Emirates (UAE), particularly to Dubai and Abu Dhabi, as finews.ch has reported a number of times. The «business hub» in the desert has become indispensable in the international competition between financial centers – and has gained even more significance because of the Ukraine war, as the UAE has not imposed sanctions on Russia.

The hub is ideally located halfway between Europe and Asia. There is also probably no other place in the world where so much money is currently being made than in Dubai and Abu Dhabi. Just on this fact alone, any financial institutions that are not there would be foregoing enormous profits – as long as they ensure proper compliance.

Whether Dubai’s significance as a financial center can be sustained in the long term is another matter. As is the norm in the world of money, you get bubbles forming everywhere and they eventually burst.

7. Is the Swiss Bankers Association still needed?

Logo of the Swiss Bankers Association (Image: SBA)

No. Many have wondered where the umbrella organization for Swiss banks was when Credit Suisse stumbled – and collapsed. The Swiss Bankers Association (SBA) contributed very little or nothing at all. Now it can be argued that it is not an association’s role to comment publicly on individual members.

But the SBA could have mitigated the reputational damage that Credit Suisse has caused, especially abroad, through the channel of the media, which would (let us not forget) also have been its responsibility, and not simply left matters to UBS CEO Sergio Ermotti.

The longer the umbrella organization fails to take a more active and forceful role in the various discussions and topics affecting the banking industry and the promotion of the financial center, the less it is needed – especially not in its current dimensions (see section 8).

8. Can the Swiss financial center maintain its leadership role as an offshore hub?

Bank safe deposit box (Image: Shutterstock)

No. The Swiss financial center is not getting worse. What is happening, rather, is that other centers are catching up, and the preferences and needs of the financial elite are shifting. This accounts for the steady decline in Switzerland’s importance as an offshore hub, a role it has played for decades.

«New» money is not primarily created in Switzerland or in Europe now. That role has been supplanted by Asia, the U.S., and the Middle East instead. For the clients there, Switzerland is no longer the top choice as a «money safe», but just one of several alternatives.

In light of this, the SBA would be well advised to take a more proactive approach to marketing Switzerland’s location qualities abroad (see section 7).

9. Can we expect to see more women in top positions in banking in 2024?

(Image: Shutterstock)

Yes. What was a desirable concern a few years ago is now a must. Women belong in management positions as they usually represent a significant part of the workforce, their skills are equal to those of men, and their qualities help make a company more diverse and reflective of our societal structure.

As welcome as the trend may be, it must though not lead to talented men being disadvantaged in favor of quotas or token exercises. Having more women in leading roles is desirable – but quality in terms of competences and complementarity still matters.

10. Is business with wealthy Russians becoming a stumbling block for Swiss banks?

Red Square in Moscow (Image: Mitya Ivanov, Unsplash)

Yes. As is evident from the tax dispute between the U.S. and Switzerland, the U.S. authorities have repeatedly shown themselves extremely uncompromising in their dealings with Swiss banks. Overall, several billion francs of fines have been sent across the Atlantic to America – most recently, with esteemed Geneva private bank Pictet, as reported by finews.ch.

To say the least, one cannot help but feel that the U.S. has a rather noteworthy interest in putting pressure on the Swiss financial center. The pretext for it this year could be the Russian funds held by Swiss financial institutions. Although Swiss banks are strictly complying with the sanctions imposed, cases keep coming to light in which they are handling Russian citizens and their financial transactions in a surprisingly accommodating manner.

Naturally, all these U.S. initiatives also come with a good dose of double standards and hypocrisy – and a policy aimed at weakening certain foreign financial centers, of which Switzerland is undoubtedly one.

But given the extraterritorial enforcement powers U.S. authorities also have, Swiss banks need to be extra cautious with Russian funds. Nevertheless, some banks will continue to underestimate this dangerous situation and that is a huge danger.