The fight for private bankers in Switzerland is heating up. British bank Barclays details which part of the pie it wants to win.

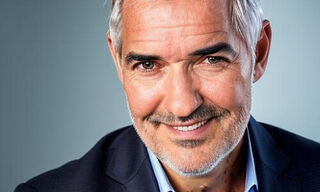

Private banking in Switzerland is far from dead – recent departures and raids at Credit Suisse or Julius Baer make this abundantly clear. Barclays also wants a piece of the hiring frenzy, Swiss unit CEO Gerald Mathieu told «Reuters».

The British bank wants to hire six to ten private bankers in the next year, said Mathieu, who moved from the bank's top job in Monaco to Geneva earlier this year. The hiring should is meant to vault Barclays over the 20 billion Swiss franc mark, which is widely viewed as critical mass for an international private bank.

Currently, Barclays' 300 staff in Switzerland is more than three-quarters of the way there when counting credit as well, Mathieu told the news agency. The bank is on track to leap past the 20 billion franc mark in the short- to mid-term. Mathieu's predecessor, James Buchanan-Michaelson, has set – and missed – a 28 billion franc target.

In August, Mathieu told finews.ch-TV of Barclays's hiring plans, saying, «One of my key priorities is to recruit the right talents for the Geneva and Zurich platform».